Payroll is one of those tedious yet vital elements for a well-run organization.

Its importance is a no-brainer, but payroll is one of those easy-to-miss tasks that often slip through the cracks — which is exactly why you need to use global payroll software tools and international payroll solutions in 2022.

Your employees’ livelihoods literally depend on it.

When their money comes in an extra week or month late, they might miss rent, be evicted, lack the funds for emergency expenses, and their lives can generally be thrown out of whack — especially given that 65% of Americans live paycheck to paycheck, according to the American Payroll Association.

As a side effect, this can cause employees to be distracted, distressed, unhappy, unproductive at work, and to feel unrecognized and uncared for.

One of the other key reasons behind using a global payroll software tool is that these software solutions typically help ensure that you are complying with the regulatory framework of various countries and jurisdictions.

“49% of workers will begin a new job search after two paycheck errors.” — Kronos Click To TweetImplementing a global payroll software tool into your corporate operations is a must so that payroll is automated, easy, and stress-free for you and your employees. That’s why we’ve compiled a list of the most reliable, well-reviewed international payroll solutions available to you.

So without further ado, check these payroll tools out and find the perfect one for your organization!

Want to improve your employee appreciation program this year?

Yes!What is global payroll software?

Global payroll software helps companies manage their payroll on a global scale. The software can be used to track employee hours, calculate taxes and deductions, and generate pay stubs. It can also ensure compliance with global labor laws and regulations.

Global payroll software also lets companies manage their currency risk by automatically converting salaries into local currency.

Top Rated Global Payroll Services For International Companies

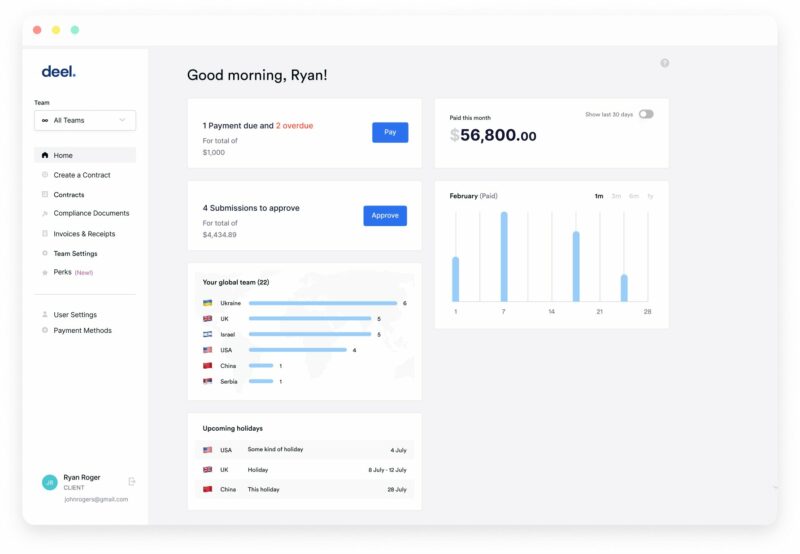

1 | Deel

Deel allows you to run payroll in more than 90 countries, streamlining operations and removing the administrative work of dealing with taxes, local compliance, benefits, and more from your plate.

Additionally, Deel helps you make data-driven decisions about locations and roles. Finance teams, office managers, legal teams, and hiring managers are all better equipped with Deel and are raving about how much easier it makes their lives.

Why we love this international payroll software tool: Deel handles taxes, compliance, government declarations, calculations, and more, so the only thing that’s left for you to do is have someone update internal changes such as promotions, terminations, raises, and new hires.

Standout Features

➝ W-2 preparation — Deel doesn’t just receive tax info and store it, but rather, it takes it a step further by preparing important tax documents.

➝ Deductions management — Deel makes it easier to keep track of deductions and ensure that they are applied correctly.

➝ Direct deposit — Every month, your contractors and employees can get their money automatically so you never skip a beat and they never have to worry about late paychecks.

Notable companies using Deel:

- Binance

- Hero Gaming

- Swift HR Solutions

Check out this review from a happy customer:

“We’ve saved a lot of time and money but also reduced the team’s administrative load for quicker turnaround.” — Veriff

Click here to learn more about Deel!

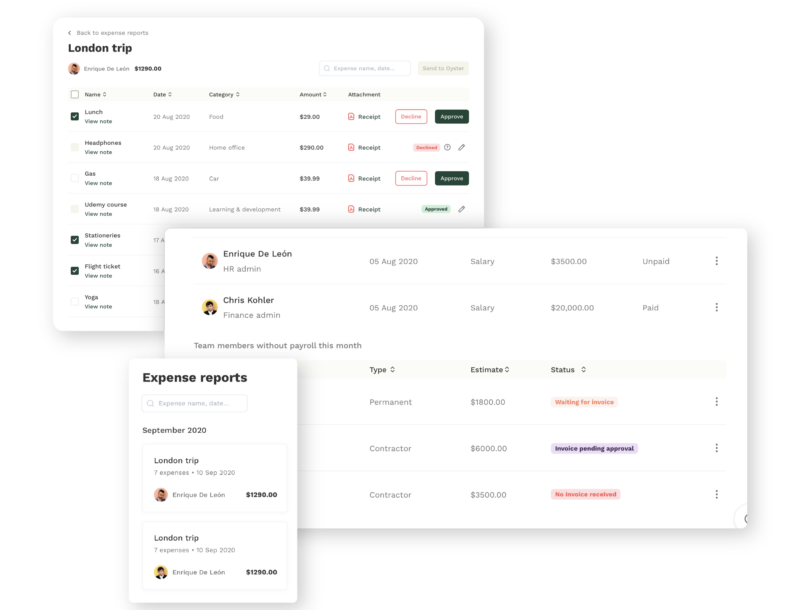

2 | Oyster

Used by companies in more than 180 countries, Oyster assists you in hiring, paying, and caring for your global team.

Tapping into the international talent pool can be an overwhelming challenge that really stops companies from getting the absolute best of the best. Oyster boosts you over that problem entirely, bringing the most elite employees from around the globe.

Why we love this international payroll software tool: With the global talent pool opened wide up, you can dive right into it. Thanks to Oyster, you will be able to acquire top-quality team members to win against your competition.

Standout Features

➝ Multi-country — Oyster gives you the ability to process payroll in multiple countries, currencies, and languages.

➝ Cost tracking — Analyze payroll costs across various countries, business entities, or employee roles.

➝ Benchmarking — Create and measure local and global benchmarks and assess how competitive your compensation is in these different markets.

Notable companies using Oyster:

- Jobbatical

- Bumble

- Quora

Check out this review from a happy customer:

“Hiring outside of your home country can be daunting. Various legalities for that specific country, holidays, terms and conditions, and the list goes on. Oyster allows me to go to their portal and see up front what it will cost me to hire my candidate, they take care of all the contracts and questions the new hire has and the process is a smooth transition to the hire date.” — Andrea N.

To find out more about how to utilize Oyster, click here!

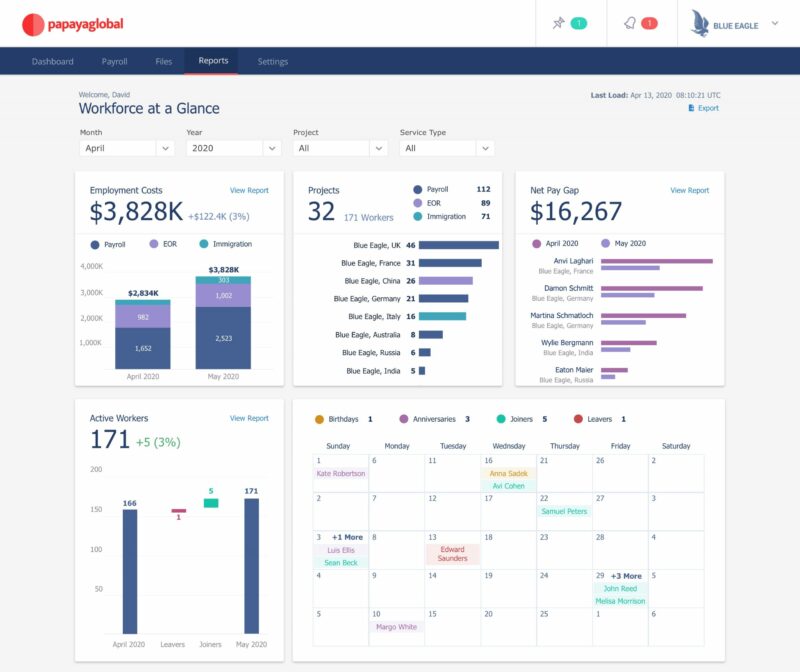

3 | Papaya Global

Papaya Global gives you all your employees’ important payroll info in one seamless dashboard for a customizable, frictionless experience.

This machine-powered international payroll solution lets you analyze the work of employees and control their vacations, sick leave, and hours of work with the immediate availability of HRIS data. Papaya Global also has a self-service portal to report PTO, view payslips, track time and attendance, and ask questions.

Why we love this international payroll software tool: Papaya Global automatically checks for documentation for compliance with regional requirements and international regulations.

Standout Features

➝ Employee profiles — Papaya Global offers a consolidated repository for worker documents in a simple-to-use HR tool dasboard.

➝ Payment request builders — This feature enables contractors to upload tax invoices and supporting documents.

➝ Dedicated Country Hub — Papaya provides professional knowledge and an in-depth Countrypedia, which helps you navigate the murky waters of global compliance.

Notable companies using Papaya Global:

- Microsoft

- Toyota

- Canva

Check out this review from a happy customer:

“I love the fact that we can manage our entire payroll process through a single point of contact; the SaaS platform which lets us examine and evaluate our workers in a glance..” — Itzhak W.

Click here to get started with Papaya Global!

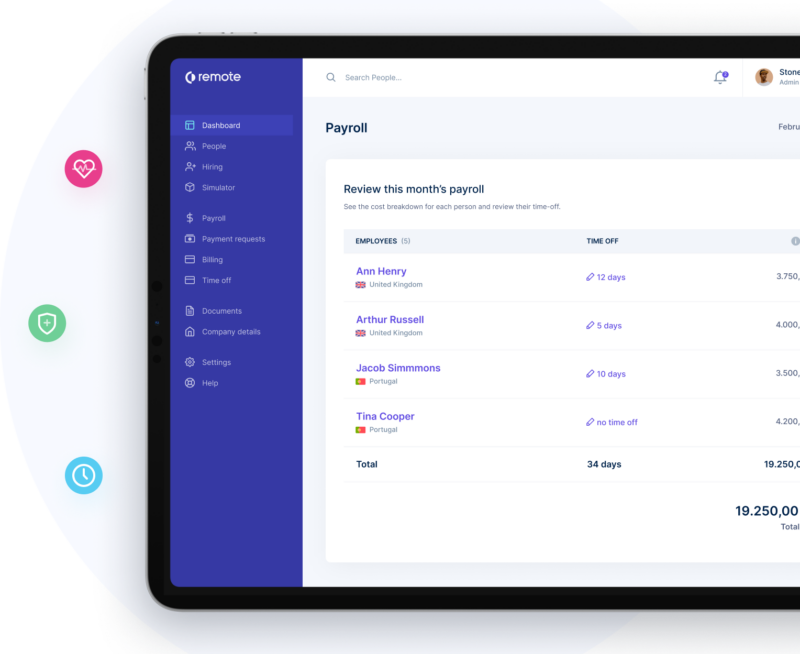

4 | Remote

Remote is a global payroll software tool to manage payments for your contractors and employees in multiple countries.

Everything from benefits management to handling payroll deductions can be done via Remote. This global payroll services provider helps you easily take care of invoice management and automation of recurring payments.

Remote can even act as an employer of record (EOR) by hiring on your behalf and can offer country-specific knowledge to aid you in hiring the best local talent in any part of the world.

Why we love this international payroll software tool: Remote offers customized employment contracts, support when using contractor tools, specialized protections for your intellectual property and invention rights, and more.

Standout Features

➝ Leave tracking — Remote lets you easily allocate, track, and allow leave for employees and it also enables employees to request and track their own leave.

➝ Attendance tracking — This payroll feature allows you to keep track of attendance and who reports to work, which is crucial when it comes to running an international business.

➝ Compensation management — Remote helps you manage employee compensation-related data in an organized and automated manner.

Notable companies using Remote:

- Doordash

- Whereby

- Hello Fresh

Check out this review from a happy customer:

“As an employee, I did not have to do much, it was straightforward to coordinate between my hiring company and Remote to get a contract enabling me to work for a North American company while living in Germany legally. The platform is very friendly and the customer support team is very fast and helpful.” — Khalil N.

To learn more about how Remote can improve your payroll process, click here!

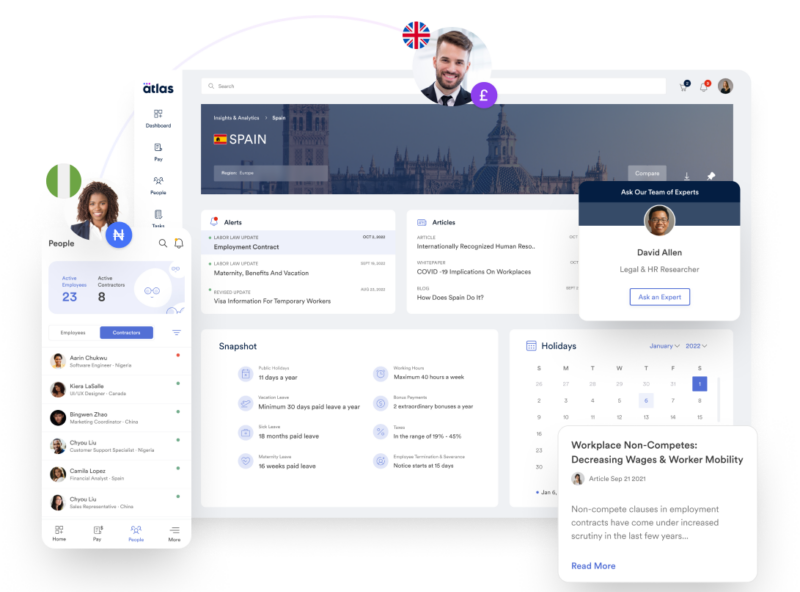

5 | Atlas

Atlas provides you the framework to establish a truly global talent infrastructure, with the flexibility to expand without the need of a local entity.

This cloud-based international payroll software is designed so that Atlas assumes the responsibility of the legal employer to assist in managing the numerous challenges of employing global teams.

Additionally, Atlas helps you manage the employee lifecycle from onboarding to processing payroll — all while dealing correctly with global compliance.

Why we love this international payroll software tool: Atlas keeps you compliant with localization frameworks for the country and regional regulations; maximizes the ROI of your people investments; improves individual experiences to boost employee engagement and productivity; hires talent anywhere; and makes faster, more deeply informed decisions based on country data-driven insights.

Standout Features

➝ Employee profiles — Atlas gives companies a comprehensive look at their employees, including their behaviors and other data.

➝ Applicant tracking — Part of running an international business is keeping track of your applicants worldwide and thanks to Atlas, that’s never been easier.

➝ Payroll management — Ideally, payroll is automated and now, with Atlas’ payroll management assisting your team in staying on top of this process, it will be.

Notable companies using Atlas:

- Namely

- Bath&Body Works

- Delivery Hero

Check out this review from a happy customer:

“Very easy-to-use payroll system and the onboarding process is seamless. Lots of assistance and feedback from the team. This is the best system I have used that manages non-UK employees and I hope they only improve with time.” — Ahmed A.

Click here to get started with Atlas!

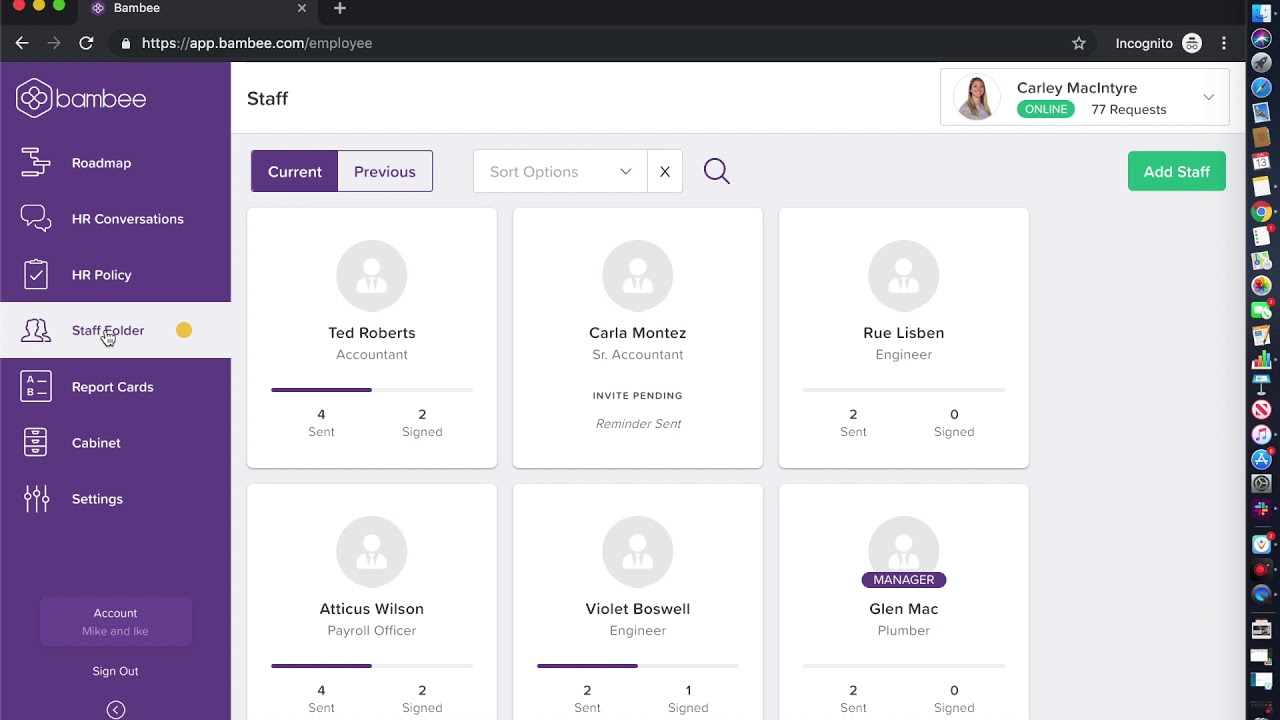

6 | Bambee

Bambee is like turning on autopilot for your HR and streamlining your policies, onboarding process, and employee training, which is why Bambee’s clients are 4x less likely to have a complaint filed against them.

With Bambee, you get a dedicated HR manager who crafts your policies and compliance. This HR outsourcing tool works in all 50 states and continues to give you coaching and guidance during the process.

Why we love this international payroll software tool: Bambee is incredibly useful as a global compliance software tool and it’s also an excellent all-around HR helper, ensuring that things run smoothly in and out of the office. Perfect for smaller teams or startups looking to upgrade their HR services.

Standout Features

➝ Compensation management — Compensation can get complicated; however, Bambee gives you a chance to majorly simplify things.

➝ HR management — When organizations scale to a global level, HR issues are bound to arise, which is why Bambee’s HR management helps track and solve these challenges as they pop up.

➝ Document management — This Bambee feature allows companies to keep all of their files and documents in order.

Notable companies using Bambee:

- Hoodz Cleaning

- Cleverly, Inc.

- LeaseLock

Check out this review from a happy customer:

“Bambee makes every part of the HR process easier. Our rep is quick and knowledgeable and gets back to me with new policies or answers to my questions within twenty-four hours. I never have to question whether or not the wait will be long, and I can tell my execs confidently that we will have an answer or a new policy the next business day.” — Michelle R.

Get started with Bambee today!

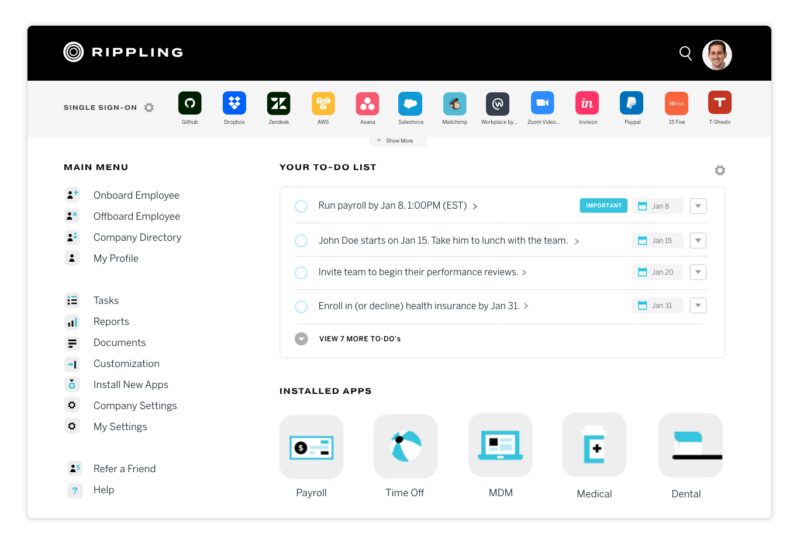

7 | Rippling

Rippling is the international payroll solution you need to run payroll in 90 seconds. This HR software syncs your business’s HR data with payroll, so you don’t have to manually enter deductions and hours, and other important but tedious information.

Why we love this international payroll software tool: Rippling has a dedicated mobile app where employees can view their W-2s, request time off, and see their pay stubs on the go. Plus, you can either use their library of pre-built reports or build and share your own using any of the data in Rippling.

Standout Features

➝ Turnover tracking — This perk can paint a clear picture of how effective your compensation is in various parts of the world as well as how engaged your global workforce feels.

➝ Timesheet management — Your remote and in-person workers can easily clock in and clock out with a few clicks.

➝ Tax compliance — One of the trickiest parts of working with different entities, governments, and regulatory bodies is the fact that they each have different rules; fortunately, the tax compliance feature makes working with all of these separate entities much simpler than if you weren’t equipped with Rippling.

Notable companies using Rippling:

- Superhuman

- Beam Dental

- Double Good

Check out this review from a happy customer:

“The app is user-friendly. With one click of a button, I can get into all the payroll info and other details such as W2s or 1099s. It laid out my benefits in great detail but also no mistaking what I was choosing between. It’s a great system and glad we switched from a more difficult system to navigate in the workday.” — Adam D.

Click here to integrate Rippling into your payroll plan!

8 | ADP

After being around for more than 70 years, ADP continues to help companies manage their payroll so that they can save money, reduce risks, and gain insights to make informed decisions.

Why we love this international payroll software tool: This international payroll solution remains up-to-date on the latest government regulations and local laws to ensure absolute global compliance. With a long list of useful features and functions, ADP has solidified itself as a leading office management tool that can be relied upon for busy teams.

Standout Features

➝ Direct deposit — ADP deposits the money directly into the bank accounts of your employees and contractors so you don’t have to worry about missing payments once you get them set up in the system.

➝ New hire reporting — This ADP feature lets you keep a close eye on your new hires, how engaged they are, their absenteeism, and other vital metrics that help support a positive work environment.

➝ Tax filing — A common theme you may have noticed between these global payroll software tools is that most of them deal with global compliance, but ADP makes filing taxes internationally ultra-convenient.

Notable companies using ADP:

- Amazon

- Bank of the West

- AWISCO

Check out this review from a happy customer:

“I love how easy it is to see all the work information you need in a simple view. You have access to hours worked, PTO, holidays, and detailed breakdown of your pay.” — McCain D.

Up your payroll game with ADP today!

People Also Ask These Questions About Global Payroll Software Solutions

Q: What is an international payroll service?

- A: An international payroll service is a type of business service that helps companies to pay their employees who are based in another country. This type of service typically includes assistance with things like calculating taxes, withholding the correct amount of money from each paycheck, and ensuring that employees are paid on time. Many international payroll services also offer other helpful guidance and resources, such as providing advice on labor laws and setting up employee benefits programs.

Q: What are the benefits of using multi-country payroll software?

- A: Multi-country payroll software can offer a number of benefits for businesses with employees in multiple countries. Perhaps most importantly, it can aid in compliance with the various tax and labor laws of each country. This can save the business both time and money, as well as prevent any potential legal penalties. Good payroll software will also offer a high degree of flexibility, allowing businesses to tailor their payroll processes to their specific needs. This can be a valuable asset for businesses with complex payroll requirements. On top of that, multi-country payroll software can help to streamline the entire payroll process, making it more efficient and less time-consuming.

Q: What are the best global payroll solutions?

- A: The best global payroll solutions offer the most utility and generally focus on handling the legalities and complexities of employing people from around the world so you do not have to stress over every little detail.

Q: How do I choose an international payroll provider?

- A: You will want to choose an international payroll provider that can service all the countries in which you operate. The first step is to identify the countries in which you have employees and then research providers who can service those countries. Some things you will want to consider include whether the provider has a local presence in the countries you operate in, how they handle compliance with local laws and regulations, and whether they offer any additional services such as employee benefits or time and attendance tracking. Once you have narrowed down your options, you can then compare prices and choose the provider that best meets your needs.

Q: How much does it cost to use a multi-country payroll company?

- A: The cost of using a multi-country payroll company can vary depending on the services used and the number of employees being paid. That said, most companies offer a range of pricing options that are designed to fit most budgets. For example, many companies offer a flat monthly fee that covers all aspects of payroll processing, including tax compliance and employee onboarding. Others may charge a per-employee fee, which can be a more cost-effective option for companies with large payrolls.

Q: How do I set up international payroll processing software?

- A: There are a few things you’ll need to do in order to set up international payroll processing software. You’ll need to choose software that is compatible with the country or countries you’re doing business in. Then, you’ll need to make sure that the software is properly configured for those countries. This includes setting the correct tax withholdings and other requirements. Once the software is properly configured, you’ll need to input your employee data. This includes their salaries, addresses, and banking information. Before you get off to the races, test the system to make sure it’s working correctly. Once everything is up and running, you’ll be able to process your employees’ and contractors’ payroll quickly and easily.