Did you already file your ERC refund?

Perhaps you’re wondering if it will ever come. Fortunately, we’ve got some answers to ease your mind and help you check the status of your Employee Retention Tax Credit.

For many people, the ERC refund is an essential source of income that helps to cover the cost of living. However, delays in the refund process can cause significant financial hardship.

The problem is that the refund is often delayed by several weeks or even months.

This can be a major problem for people who are already struggling to make ends meet. In some cases, the delay can even lead to evictions or foreclosures. The good news is that there are steps you can take to minimize the chances of a delay. For instance, you can make sure to file your payroll tax and other taxes on time and accurately.

You can also keep track of your refund status so that you can follow up if it seems to be taking longer than usual.

By taking these precautions, you can help ensure that you receive your refund promptly. However, the Employee Retention Tax Credit is complex and has been amended several times, which is why this article is intended to help simplify the ERC and help you stay on top of it.

So without further ado, let’s get right into all the nitty-gritty details of the ERC refund process!

Have You Heard Of The Employee Retention Credit?

See If You QualifyHow do I check the status of my ERC refund?

To check the status of your ERTC refund, you will need to contact the IRS. You can do this by calling the IRS helpline or by visiting the IRS website. When you contact the IRS, be sure to have your Social Security number, employer identification number, and tax return information ready.

The IRS will use this information to help locate your refund. Once you have contacted the IRS, you should receive a notice within four weeks about the status of your refund. If you do not receive a notice within four weeks, you may need to file Form 8849 (Claim for Refund of Excise Taxes).

How long does it take to get your ERC refund?

The credit will be refunded to the employer when they file their annual tax return. For employers who have already filed their 2020 return, the IRS will automatically process the credit and issue a refund.

Therefore, most employers can expect to receive their ERTC refund within eight to 10 weeks after filing their return. However, if an employer has not yet filed their return, they should expect to receive their refund within two to three months after filing.

➤ Impact of COVID-19 on ERTC

The COVID-19 pandemic has had a significant impact on businesses across the country. Many businesses have been forced to lay off employees or reduce their hours, and as a result, the employee retention tax credit has become an increasingly important tool for businesses.

The credit is designed to encourage businesses to keep employees on their payroll during periods of economic hardship.

The pandemic has highlighted the importance of the credit, and many businesses are now using it to help retain their workers. In addition, the credit has also been expanded in recent months to cover a wider range of businesses and employees.

As outbreaks and pandemics become a more common occurrence, the employee retention tax credit and similar programs like the Paycheck Protection Program (PPP) are likely to play an even more vital role in helping businesses keep their workers employed.

➤ ERC Refund Delays

➤ ERC Refund Delays

The Employee Retention Credit is refundable, which means that businesses can receive a refund if they have already paid their taxes for the year. However, many businesses have experienced delays in receiving their refunds. The IRS has attributed the delays to the high volume of ERTC claims and the complex nature of the credit. As a result, many businesses are still waiting for their refunds.

➤ How to get my ERC refund faster

Businesses can choose to apply for an advance payment of the credit by filing Form 7200. This form is due on the first day of the quarter in which the business wants to receive the advance payment. For example, if a business wants to receive an advance payment for the second quarter (April 1-June 30), it would need to file Form 7200 by April 1.

The IRS will then issue a check or direct deposit within two weeks. By filing Form 7200, businesses can get their ERTC refund faster and use it to help offset the cost of keeping employees on the payroll during these difficult times. This is just one example of an employee retention credit claim being expedited with a little bit of knowledge and know-how.

How to Check Your IRS ERC Refund Status

1) Talk to your ERC filing service

1) Talk to your ERC filing service

Many businesses are not aware of this credit or how to claim it. That’s where talking to your employee retention credit service can help. As a result, you can get your ERC refund faster and use it to help keep your business running during these difficult times. They now only know how to accurately calculate your ERC, but can provide useful tips to claim and file your refund on time.

Why this can help check the status of your ERC refund: A knowledgeable service can help you determine if you are eligible for the credit and how to claim it on your return.

Tip: Take this 60 second quiz to see if you qualify for the ERTC today!

2) Call the IRS directly

The IRS website has a dedicated page for the Employee Retention Credit, and the page includes a link to a phone number specifically for questions about the credit.

Calling this number will put you in touch with an IRS representative who can answer your ERTC questions and help you get your refund as quickly as possible. In addition, the IRS has an online tool that can help you figure out your eligibility for the credit.

Why this can help check the status of your ERC refund: By taking a few minutes to call the IRS or use their online tool, you can save yourself a lot of time and hassle when it comes to getting your Employee Retention Credit refund.

3) Check out the Refund Status tool

The IRS has a great tool that allows you to check the status of your refunds. The refund tool is very user-friendly and helps you keep track of your refunds. By checking the status of your refunds, you can get your Employee Retention Credit refund faster. Additionally, the refund tool will help you to correct any mistakes that you may have made on your return to ensure the entire process goes as smoothly as possible.

Why this can help check the status of your ERC refund: The refund tool is updated daily, so you can always check on the status of your refund: https://sa.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp

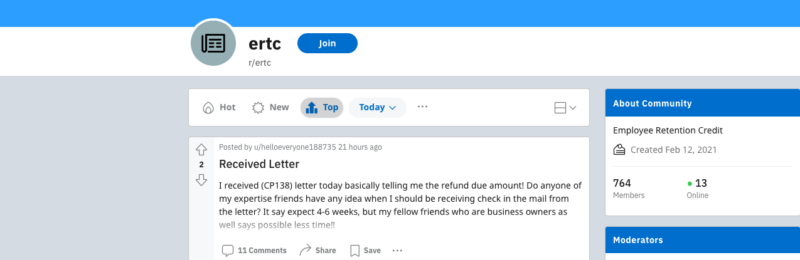

ERC Refund Status Reddit Threads

As businesses across the country continue to grapple with the fallout from the COVID-19 pandemic, many are taking advantage of the employee retention tax credit (ERTC).

Reddit is filled with threads discussing the ERTC and how best to take advantage of it. From small businesses trying to figure out how to keep their doors open to larger companies trying to decide if they should lay off workers or take advantage of the credit, there is no shortage of discussion on this topic. These threads are also helpful places to learn tips, identify potential ERTC scams and fraud, and learn more about the entire process.

As businesses continue to navigate these uncharted waters, it’s clear that the ERTC will play a crucial role in helping many companies stay afloat. Check our r/ERTC to learn more!

We waited 14 months for 3 or our checks and just received them with interest! Woo hoo! from ertc

ERTC TIMELINE from ertc

People Also Ask These Questions About The Status Of Their ERC Refund

Q: Has anyone received their ERC refund?

- A: Yes, employers and companies have received their ERC refund. To date, over $50 billion has been paid out in refunds to companies. The refunds have ranged from a few thousand dollars to over $1 million. The average refund is around $130,000. The majority of businesses that have received a refund are small businesses with less than 50 employees. However, some large companies have also benefited from the credit. For example, grocery store chain Kroger has received a refund of $21 million. The employee retention tax credit has been a lifeline for many businesses during these difficult times. It has helped them keep their employees employed and has prevented many layoffs.

Q: How do I check the status of my 941x refund?

- A: You can check the status of your 941x refund by logging into your account on the IRS website. Once you are logged in, click on the “My Account” tab and then select the “Payments” option. From there, you will be able to see a list of all the payments you have made to the IRS, as well as the status of any refunds and refund checks you may have received. If your refund has been processed, it will show up as “paid” on this list. If you have any questions about your refund, you can contact the IRS customer service number for assistance.

Q: Are there ERC refund delays?

- A: Yes, there are ERC refund delays. Employers who are claiming the credit may experience delays in receiving their refunds. The IRS has said that it is working to expedite the processing of ERTC refund claims and the large backlog of applications, but it is unclear how long the process will take. In addition, the IRS, similarly to the private sector is also experiencing a staffing shortage. In the meantime, employers should be aware of the possibility of delays and plan accordingly.

Q: How can I receive my employee retention tax credit refund faster?

- A: There are a few ways to speed up the Employee Retention Tax Credit process. First, businesses can file for an expedited refund by including a statement with their return that explains why they need the money quickly. Second, businesses can make an estimated tax payment using Form 4466, which will reduce the amount of time it takes to receive a refund. Finally, businesses can contact their local IRS office to inquire about the status of their refund. By taking these steps, businesses can get their employee retention tax credit refunds faster. Also, always be sure to consult with your CPA about next steps as well as your ERC filing company to help assess your return status.

➤

➤ 1) Talk to your ERC filing service

1) Talk to your ERC filing service